Charles Scharf, CEO of Wells Fargo, has been at the helm since October 2019.

The 55-year-old made some controversial remarks a few months ago that are now coming to light.

What’s worse is that he said them more than once.

First, he said them at a summer Zoom meeting.

Then, he repeated them in a June 18 memo on diversity initiatives.

The Comments

Per Reuters who obtained a copy of the memo, Scharf defended the company’s apparent lack of diversity by stating:

“While it might sound like an excuse, the unfortunate reality is that there is a very limited pool of black talent to recruit from.”

To put it in context, these comments were shared during the nationwide civil unrest surrounding the May 25, 2020 murder of George Floyd.

Two employees on the Zoom call shared the comments under the condition of anonymity; they were both offended by Scharf’s words.

Mixed Reactions

While they were offended by Scharf’s comments during the 90 minute Zoom meeting, others were not.

Alex David, President of the Black/African American Connection Team Member Network said:

“The meeting was incredibly constructive…. I walked away being incredibly surprised at how genuine and sincere he is.”

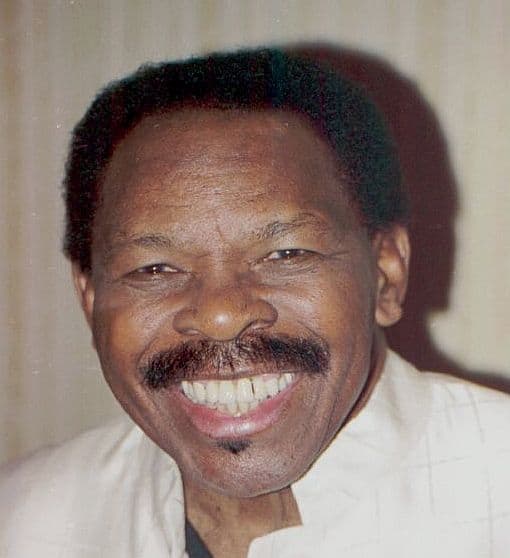

Ken Bacon, a former mortgage industry executive on the boards of Comcast Corp, Ally Financial Inc, and Welltower Inc. disagrees.

“If people say they can’t find the talent, they either aren’t looking hard enough or don’t want to find it.”

Wells Fargo literally just admitted racial profiling and discrimination on a national platform

— 弥助 (@LeeTRBL) September 22, 2020

Corporate Response

As expected, Wells Fargo responded in damage control mode.

A statement from our CEO regarding the recent media reports: pic.twitter.com/HBdzDxoTdh

— Wells Fargo (@WellsFargo) September 23, 2020

Slow, Painful Progress

Diversity is a buzzword in corporate America, but the process of improving it is slow and painful.

Mary Winston, a director at companies including Chipotle Mexican Grill Inc. said:

“Unless I practically get on a soapbox about it and ask about it every meeting, it gets pushed out. It’s just not as robust a conversation as it should be, and no progress has been made.”

One of the employees who reported the comments disagrees that African American talent is lacking.

“I can get them 10 to 15 resumes today.”

Wells Fargo’s String Of Controversies Continues.

Fraud

Scharf’s comments are just the latest controversy for Wells Fargo.

In September 2016, the company was fined $185 million for opening accounts and credit cards without customers’ consent.

Customers did not know about the accounts until they started to incur charges.

From 2011 through 2016, approximately 1.5 million unauthorized bank accounts and 565,000 credit cards were opened by employees.

Wells Fargo called for a culture change, and 5,300 employees were fired as a result.

Foreclosures

A computer glitch resulted in 600 people losing their homes between April 2010 to October 2015.

Wells Fargo admitted that an error in its underwriting tool caused the problem.

“As a result of this error, approximately 625 customers were incorrectly denied a loan modification or were not offered a modification in cases where they would have otherwise qualified. In approximately 400 of these instances, after the loan modification was denied or the customer was deemed ineligible to be offered a loan modification, a foreclosure was completed.”

Add-Ons

Wells Fargo allegedly charged customers for add-ons they never requested in 2018.

Pet insurance, legal services, and other charges were rendered to unsuspecting customers for years.

In response, Wells Fargo issued this statement indicating it was:

NEXT: Adeline Fagain, 28 Year Old Houston Doctor Dies From COVID-19“reviewing add-on products sold to consumers by the bank or its service providers and if issues are found during this review, we will make things right with customers in the form of refunds or remediation.”